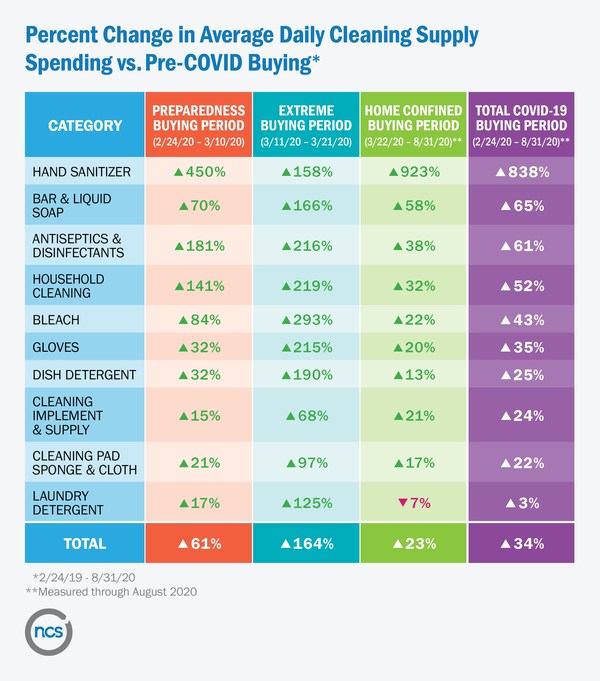

NEW YORK,, Sept. 15, 2020 /PRNewswire/ -- As cleaning, safety and wellness products continue to be a priority for American households, spending on this segment has increased 34% since COVID-related worries began at the end of February. These findings are part of new data released by NCSolutions (NCS), the leading company for improving advertising effectiveness for the consumer packaged goods ecosystem.

Sales of hand sanitizer notched the highest gain in the category over the period — up 838% — followed by bar and liquid soap (+65%) and antiseptics and disinfectants (+61%). Concern with keeping home, work and school environments clean is a driving factor behind American spending behavior on these products.

"We've entered a new era for cleaning. Hand sanitizers, disinfectant wipes and sprays are our constant companions, providing a sense of psychological security and control during a period of unknowns," said Linda Dupree, CEO, NCSolutions. "We're taking preventative measures seriously, and higher spending on these products is proof consumers are adopting new behaviors."

"I can't imagine the pressing need to clean and have these types of products on hand waning anytime soon," Dupree added. "As we venture out more, we're going to come into contact with more contamination points, from school desks to gym equipment and mass transit. We can expect sales of cleaning supplies to remain elevated for the long-term."

NCS has defined distinct periods of COVID-19 buying based on consumer spending behavior. During the Extreme Buying phase between March 11 and March 21, household spending on the cleaning segment jumped 164%, compared to pre-COVID-19 levels. Months into the pandemic, consumer spending on cleaning supplies is still 23% elevated in the Home-Confined Buying period compared to pre-COVID-19 levels.

And yet, consumers continue to have trouble finding household cleaning products. According to NCS's findings, 38% of U.S. retailers remain out of stock for household cleaning products for some part of the day, and 11% report being out of stock for most of the day. Shortages of cleaning supplies began during the Extreme Buying period, when 4% of U.S. stores were stocked out of these products for most of the day. This rate continued to rise until June, when 11% reported stockouts. This percentage has remained constant throughout the summer.

Spending on paper towels, a product closely associated with cleaning, is 18% higher since the start of the pandemic. Sales began to increase during the Preparedness Buying Phase (February 24 - March 10) and paper towels have continued to be a sought-after item, even as retail stores struggled to keep them in stock. NCS data show sales of paper towels have been on an upward trajectory since March, though spending began to level off in May. Other items with sustained elevated sales include laundry detergent, bleach, cleaning implements and supplies, cleaning pad sponges and cloths, dish detergent and gloves.

"CPG advertisers find themselves in a unique spot. Demand for CPG products is clearly up, but there's no guidebook for advertising in a pandemic. Since must-have items in the category, such as hand sanitizer, soap and disinfectants, are still hard to find, many consumers are trying new products and brands," Dupree said. "To meet consumers where they are, brands are going to have to sharpen their focus on who their buyers are, what creative resonates and where to reach them. Acting on these insights is the only way to improve advertising effectiveness — in a pandemic or any other time."

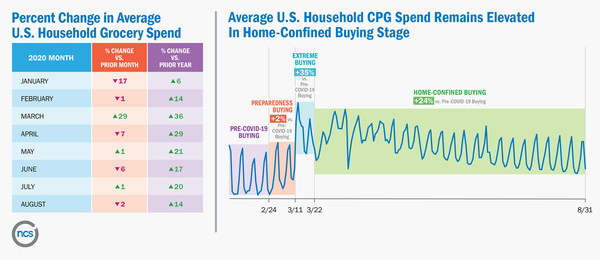

NCSolutions Consumer Packaged Goods Monthly Tracker for August 2020

Six months into the pandemic, American households continue to buy consumer packaged goods at a higher-than-normal pace. Overall, sales are up 24% since the Home-Confined Buying period began on March 22 and continues today, compared to the pre-COVID period (February 1 - February 23, 2020). Average daily sales are up 14% in August compared to the same period last year.

For the latest trends in consumer purchasing behavior, visit us online or drop us a line at the email one of the emails below.

ABOUT NCS

NCSolutions (NCS) makes advertising work better. Our unrivaled data resources powered by leading providers combine with scientific rigor and leading-edge technology to empower the CPG ecosystem to create and deliver more effective advertising. With NCS's proven approach, brands are achieving continuous optimization everywhere ads appear, through purchase-based audience targeting and sales measurement solutions that have impacted over $25 billion in media spend for our customers. NCS has offices in NYC, Chicago, Tampa, and Cincinnati. Visit us at ncsolutions.com or to learn more.

SOURCE NCSolutions